Retail Price Optimization

Turn pricing from a daily grind into a strategic advantage.

ClearDemand helps retailers take control of pricing with AI-driven demand modeling, patented pricing rules, and transparent optimization. Unlike other optimization tools, our retail-specific solution shows you the why behind every recommendation. Merchants trust it, executives support it, and shoppers feel it at the shelf. Let’s work together for retail prices that protect margin, strengthen loyalty, and give you confidence to win in a competitive market.

- Optimize prices for the entire store, including fresh

- Prioritize multiple rules when conflicts arise

- Incorporate KVIs and category targets

- Ensure rule adherence while balancing compliance costs

PATENTED SCIENCE

- Model demand and calculate elasticity for every item and location

- Manage out-of-stocks and use AI to infer demand

- Forecast expected sales, margins, and results before hitting approve

- Quantify the value gained from every price adjustment

Price Optimization is Your Solution to Growth

Confidently execute your retail price strategy. Combine patented science and business rules to set competitive prices that drive bigger baskets and customer loyalty.

Bigger Baskets

Keep prices sharp across channels and drive repeat trips.

Price Image

Strengthen trust with shoppers who notice value – not volatility.

Competitive Moves

See and react to market shifts before competitors do.

Built on Science. Designed for Retailers.

Predictive Demand Modeling

- Anticipates shopper response to price and promotion changes with precision.

Business Rule Optimization

- Aligns price recommendations with your strategy and guardrails.

Profitability Balance

- Maximizes profit while maintaining compliance, avoiding rounding or rule conflicts.

Simplify Pricing. Amplify Results.

TRANSPARENT INSIGHTS

Easily understand the “why” behind every pricing recommendation to empower data-driven decisions and stakeholder trust.

WHAT-IF ANALYSIS

Simulate pricing scenarios to assess risks, optimize benefits, and sharpen your approach before implementing changes.

OPTIMIZE PRICES

Hit revenue, profitability, and competitive targets for all categories through innovative science and comprehensive business rules.

Is It Time to Reevaluate Your Pricing Strategies?

Every retailer places importance on winning and value through price, but we know not all have great performance. Price optimization is the most powerful and immediate levers to winning trips, sales, and margin.

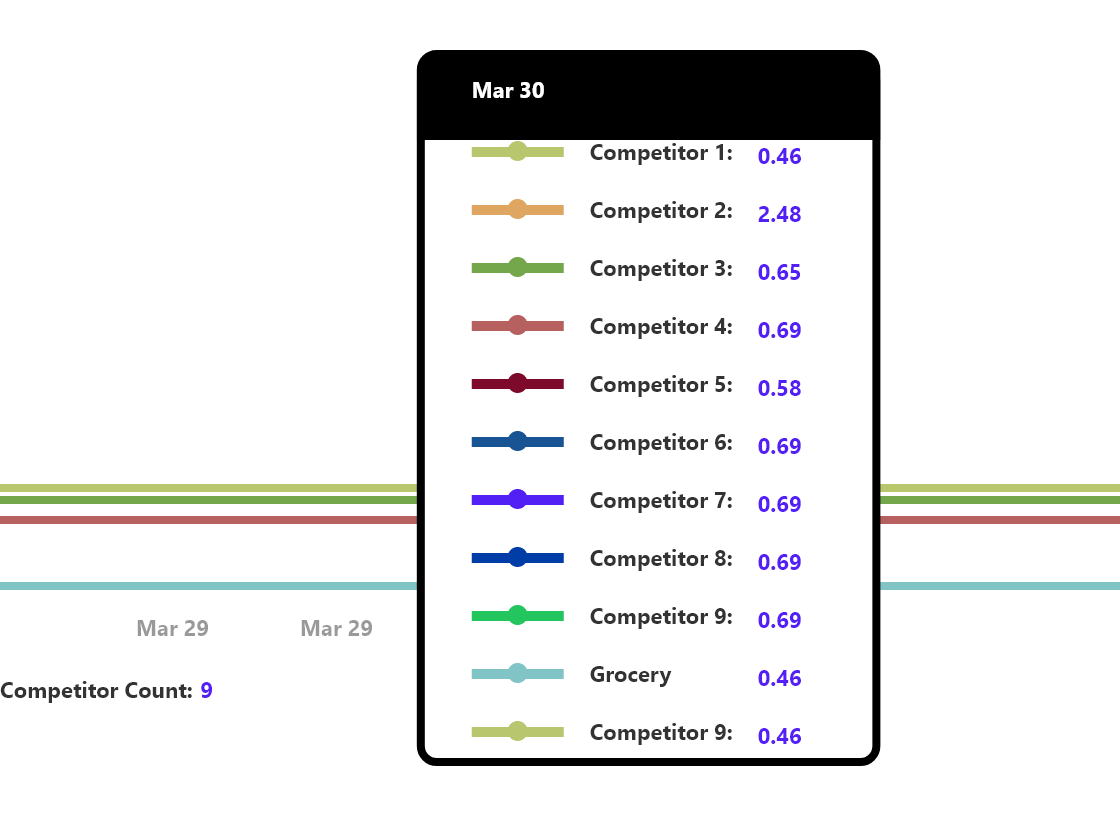

Competitive Intelligence

Empower confident decisions with complete market intelligence

- Analyze competitor pricing trends and promotional strategies

- Identify competitive gaps and capitalize on pricing opportunities

- Make informed, data-driven decisions around your pricing strategy

Promotion Optimization

Create targeted, effective events to boost sales

- Plan and execute promotions that drive sales and customer loyalty

- Track promotion effectiveness and optimize future campaigns

- Evaluate scenarios and minimize risks to find the ideal selection and price

Markdown Optimization

Avoid profit loss from poorly timed discounts

- Adjust markdowns to fir your strategy

- Forecast demand to optimize timing and discount plans

- Balance profit and sell-through to clear inventory efficiently

Confidently Execute Winning Prices

You don’t have to choose between profit and perception.

ClearDemand helps you act faster, price smarter, and protect every margin point.

Saved in inventory write-offs across categories

Increase In Sales Based On Product Popularity And Category

Reduction in cleansing and auditing time