How Precision Pricing Measures True, Incremental Value

Reading Time: 13 Minutes

Isolating and measuring the true impact of price changes on revenue and profit is essential for optimizing strategy.

A precise, efficient approach builds trust among category managers and merchandisers, ensuring confident adoption of pricing recommendations.

This guide examines the most common measurement methods, their pros and cons, and how ClearDemand’s proprietary elasticity-based optimization delivers the most reliable insights – driving alignment and maximizing sales and margin.

Selecting the Best Approach

For any retailer who has ever tried to measure the incremental profit and revenue created (or destroyed) by implementing price changes, you know the first thing you need to tackle is choosing a defensible and accurate approach. The critical challenge lies in establishing a reliable baseline for comparison. There’s no shortage of options to choose from and each comes with their own tradeoffs.

The following table outlines the most common value measurement approaches, highlighting their respective strengths and limitations.

At ClearDemand, we believe elasticity-based modeling offers the ideal balance of accuracy, scalability, and practicality.

Our models continuously refine themselves using the grocer’s own data, becoming more precise as they gather more information. This results in increasingly accurate value measurement, as well as more reliable pricing recommendations. The approach also provides fast feedback loops, enabling teams to quickly validate the impact of their pricing actions and build trust in their decisions. We’ve put this into practice with customers and the results have been extremely impactful and impressive.

What is “Elasticity-Based Modeling”?

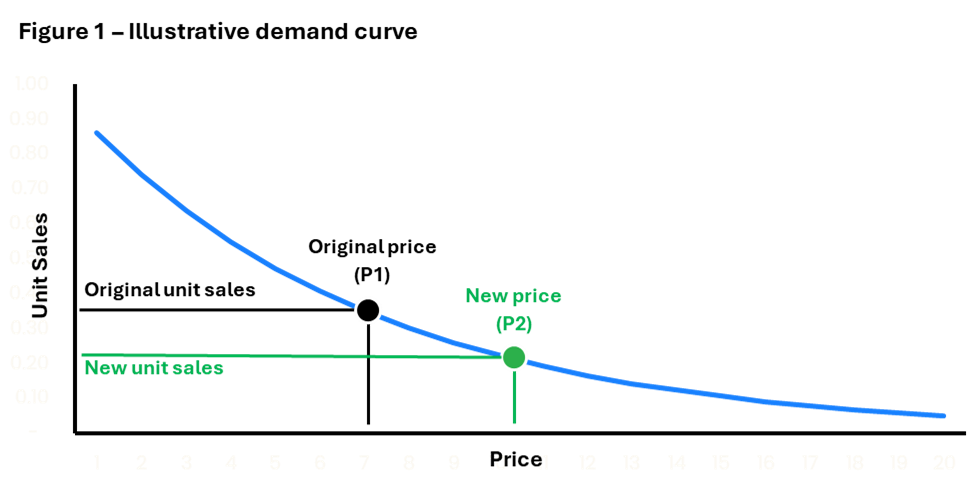

At the heart of price elasticity is a fundamental market dynamic: as product prices rise, shopper demand typically falls, and conversely, as prices drop, demand increases. While exceptions exist, like luxury goods, this pattern holds especially true for grocery and most general merchandise items.

Figure 1 illustrates this relationship between pricing and expected unit sales.

Simple example of raising Honey Nut Cheerios prices

When a category manager at a retail grocer wants to maximize margin on family-size boxes of Honey Nut Cheerios, they face multiple pricing constraints along with their three fundamental pricing options:

- Maintain current pricing if analysis shows they’re already at the optimal price point for margin

- Increase prices if the elasticity analysis indicates that higher unit profits will outweigh reduced sales volume

- Decrease prices if analysis shows the increased sales volume will more than offset lower per-unit margins

Using ClearDemand’s price optimization platform, the retailer analyzes this SKU in the context of the various rules and pricing constraints such as competitor positioning, price gaps to store-brand honey oat cereal, package size relationships to other Honey Nut Cheerios SKUs, etc. ClearDemand’s analysis reveals that increasing the price from $4.49 to $4.79 will optimize margin while respecting all these constraints. After merchandising approval, the price change is implemented.

Now the retailer needs to measure whether this change is achieving their margin growth objective. To assess the impact, we need to measure how this change affected sales. In a simple scenario with no other influencing factors, the effect would be easy to track: sales volume would drop in a predictable way, directly tied to the price increase.

The data would look similar to what’s shown in Figure 2.

More realistic example of raising Honey Nut Cheerios prices

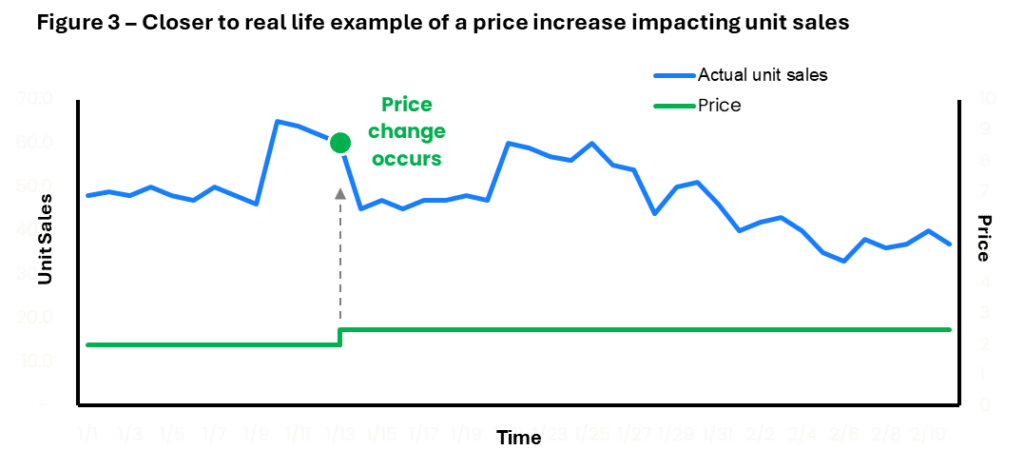

In reality, pricing changes don’t happen in a vacuum – many other factors influence sales. Honey Nut Cheerios follows different purchasing patterns, with peaks during back-to-school season. Stockouts happen. A promotion on milk could drive up sales. Holidays, like Christmas break – when kids are home boost demand, while a manufacturing issue or competing cereal promotion could reduce purchases. All these variables make it harder to isolate the exact impact of a price change.

As shown in Figure 3, the data in real life is much messier than our simple example, making it more challenging to determine the precise effect of a price increase.

Overcoming the Complexity

To cut through this complexity and isolate true pricing impacts, ClearDemand has developed a value measurement process that leverages our advanced elasticity modeling capabilities.

The approach separates pricing effects from all other market variables, giving retailers confidence in their pricing decisions.

- Define the measurement timeframe: Establish a specific analysis period starting from today looking backwards to when the price change was first implemented

- Collect actual sales data: Gather the actual unit sales data that occurred during this period with the new pricing in place. This is referred to as the “Actual Unit Sales” measurement.

- Ensure the elasticity model is up to date: Incorporate the most recent sales data into our product-specific elasticity model to ensure our subsequent calculations reflect the most accurate conditions and consumer behavior for the time period we are about to measure.

- Generate the back casted “what-if” scenario: Using the updated elasticity model, calculate what sales would have been if prices had remained unchanged. This produces what is referred to as the “Static Unit Sales” projection.

- Calculate the sales difference: Determine the precise unit sales variance between the actual results and the static projection. This isolated difference represents the direct impact of the price change.

- Calculate the profit impact: Apply the original profit margin (shopper price minus retailer cost) to quantify the profit difference

Steps 3 and 4 are critical because they are specifically what allow us to isolate the specific impact of pricing from all other factors that influence consumer demand such as seasonality and competitor actions.

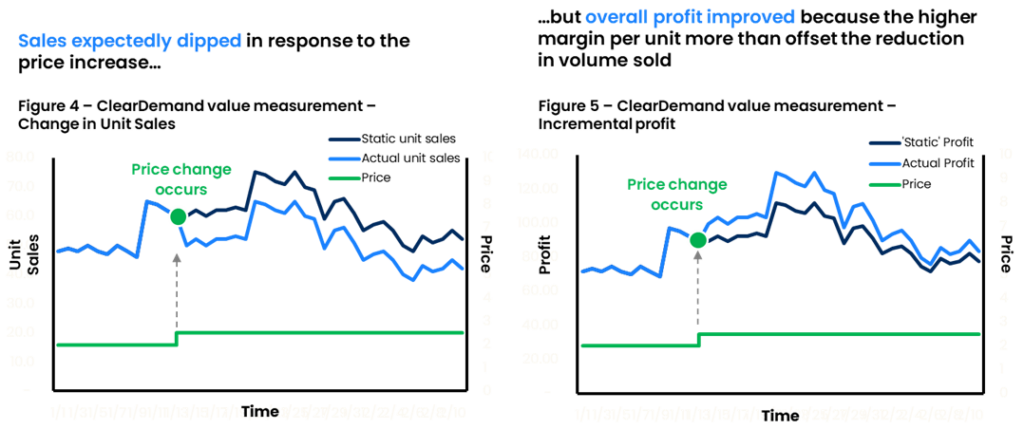

An illustrative view of this process is shown in Figures 4 and 5 below.

The two unit sales lines – actual sales after the price change and projected sales if prices hadn’t changed (static unit sales) – move in parallel patterns. This provides assurance that we’ve successfully isolated the price change impact from all other market variables. This clarity allows the grocer in our illustrative example to confidently know that their price increase on family-size Honey Nut Cheerios delivered the incremental profit they expected.

The value ClearDemand can bring to your pricing capabilities

Measuring the true impact of pricing changes is more than a data exercise—it’s a critical strategic capability.

Traditional approaches often fail to isolate the precise financial effects of pricing decisions, leaving retailers guessing about true performance. At ClearDemand, we don’t just provide a software solution – we become a strategic partner in your pricing journey. Our team works closely with retailers to understand their unique business challenges, market positioning, and strategic objectives.

Our elasticity-based modeling transforms value measurement from an imprecise art to a rigorous science. We provide a scalable approach that goes beyond identifying optimal price points, delivering real-time market insights and putting pricing adjustments on autopilot.

The result is a pricing strategy that adapts quickly, drives higher sales, and improves profit margins while aligning perfectly with your strategic financial goals.

Ready to transform how you think about pricing? Contact our team to discover how ClearDemand can unlock value for your company today.

The Latest Insights – Straight to Your Inbox

Sign up for the ClearDemand mailing list for actionable strategies, upcoming events, industry trends, and company news.