Why KVIs are Critical to Staying Competitive in Retail

Reading Time: 10 Minutes

I recently read a McKinsey article that says in today’s data-rich retail environment, retailers should apply the power of analytics and intelligence to improve price perception (which can boost sales and profit). That resonates. Accurate data and insightful analytics will guide your team to identify the right prices, which will build loyalty and accelerate your growth.

The secret to improve price perception lies in your key value items or known value items (KVIs). KVIs drive the price-value perception of a retailer by its customers.

Price Perception and CPI

Price perception is not the same as your competitor price index (CPI).

CPI is an aggregate metric that shows the price difference between you and your competitor.

Price perception is inferred worth – figured from your consumer’s mind.

So, as a retailer… even if you’re selling a key product for a lower price than your peers, if the shopper thinks you’re more expensive… reality doesn’t matter. And the thing is, a good price perception drives sales.

Dunnhumby reports that you can learn shoppers’ price perceptions by simply asking the ‘price gap’ question; “how much will this basket cost me at Store A, Store B, or Store C?”.

Define Your KVIs

When retail businesses develop a price-value strategy, they’re deciding which products influence the business,” Rajat Nigam, Bungee Tech’s founder and CEO explains. (Bungee Tech is now part of ClearDemand.) “Remember – value items are usually the products that your consumers most often compare prices for; KVIs are not infinite.”

KVIs are the items that customers usually purchase when they shop. For the most part, value items are the products that consumers remember prices for, and understanding KVIs is an increasingly important tactical advantage.

Here’s an example of a KVI for grocery retailers:

Items like bananas, milk, and eggs are great examples because they’re frequently purchased, and most shoppers notice what they pay for these products.

Let’s focus on eggs (whose prices made plenty of headlines in the past year!). If let’s say – eggs – are priced low at Store A, then most consumers assume the other products they’re purchasing are priced low. Now, go to Store B where eggs are priced a bit higher than Store A. The consumer will believe the whole store is more expensive.

There are different KVI strategies… some encourage incremental purchases during a shopper’s trip. Others highlight the retailer’s exclusive assortment, and some KVIs inspire incremental shopping trips.

And while customers demand value, they’re only truly sensitive to a number of items. If you can identify your KVIs, you can create a pricing strategy that keeps value perception high while remaining competitive in the market.

Add Data for Results

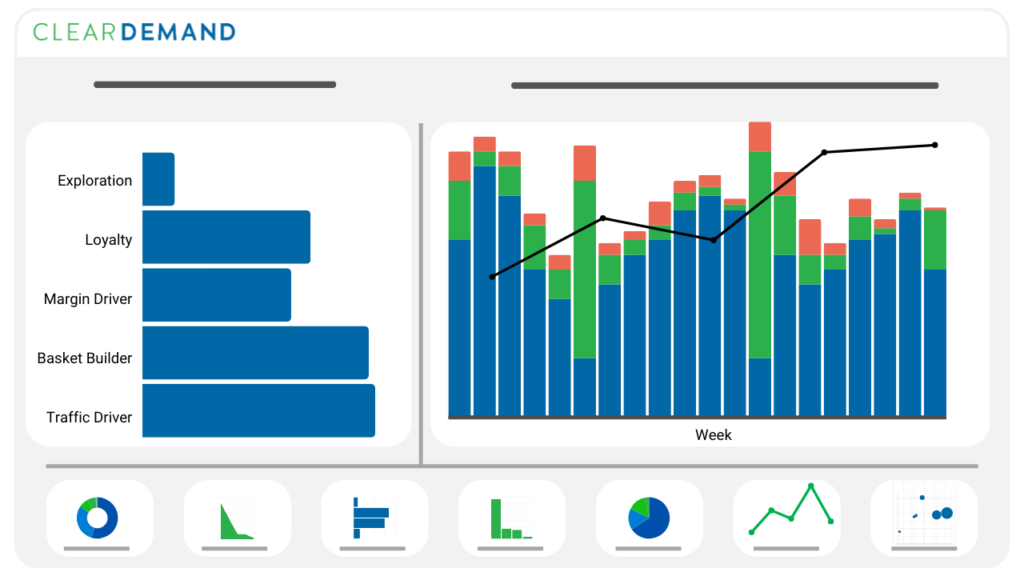

Decisions about your key value items and pricing strategies can be identified through data and analytics.

A lot of retailers identify too many products as KVIs. Realistically, maybe 10% – 20% of products are key value items. To understand every product’s performance, you need accurate data.

So, where do you get the data? Lots of data sources are helpful here – syndicated, vendor portal, in-store audits… But the importance of web data cannot be underestimated when you want a comprehensive view of the market’s prices.

Ways to use retail data and analytics to determine KVIs:

- Understand your pricing and assortment strategy compared to your competitors

- List products that bring the most customers to your store

- Implement a market basket analysis to identify the items that lead to incremental purchases

- Consider customer sentiment so you know what drives a customer to buy in the first place

- Separate your KVIs by geographies and channels

- Price KVIs in relation to your competitors (competitive intelligence helps here)

- Analyze the results and reevaluate KVIs regularly

Use your data to drive growth – don’t overlook opportunities for smarter pricing that influence your price-value.

Strategize: KVIs + Prize Zones

“We recommend you look at your data at a zip-code level,” Nigam explains. “It makes sense for most retailers to have different key items based on location.” That’s because most retail businesses have multiple price zones and should have flexibility into a specific market’s competition and customer needs.

A price zone is a grouping of a retailer’s stores that have consistent pricing across all similar products.

Amazon.com is the simplest example of price zones as they only have 1 price zone for the entire country. This means that any product you see on Amazon is the exact same price whether you live in San Francisco, CA or Jackson, MS.

Retail’s KVI Data Solution

Retailers, you already know… pricing is incredibly competitive. To win on price-value, implement a KVI strategy. It’ll drives sales. Protect how your store is perceived by offering shoppers the right prices on the items they value most.

Inspired to set your KVIs and build pricing strategies with accurate data?

Try our solutions! Our competitive intelligence program will help you outpace the competition with accurate, intraday, zip-code level data for a broad view of the market »

The Latest Insights – Straight to Your Inbox

Sign up for the ClearDemand mailing list for actionable strategies, upcoming events, industry trends, and company news.