Assortment Analytics for Grocery Retailers: How to Cut Cost, Not Opportunity

Reading Time: 8 Minutes

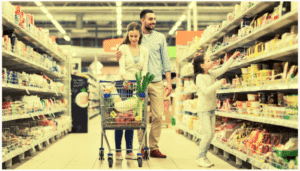

The right assortment drives trip frequency, basket size, and shopper loyalty. You’re probably carrying more SKUs than you need. And that’s not just an issue for shelf space. It’s a margin issue. A labor issue. A drag on profitability.

But don’t just cut items blindly or question your entire assortment strategy.

There are scientific analyses you can rely on. It’s not just about getting rid of slow movers… it’s about optimizing the selection that stays, understanding what goes, and identifying what should be added to meet shopper demand.

That’s where SKU rationalization and assortment gap management come in.

What’s the Difference?

SKU rationalization is the efficient process of analyzing your product assortment to determine which items should be removed from stores or regions where they underperform, stocked differently, should be added to stores where they’re missing demand. The goal is to reduce duplication, cut unprofitable items, and simplify assortment. Grocers typically drive this process because of the desire to streamline operations and remove poor-performing SKUs.

Assortment gap management fills in the blanks. It helps retailers identify which products are missing from your assortment – products that shoppers expect, that competitors carry, or that align with regional preferences.

Together, these two strategies form the foundation of assortment optimization – keeping your shelves profitable with what the selection that shoppers want most.

Why Assortment Matters in Grocery Retail

Because you’re operating in a high-stakes environment, every product on your shelf should earn its spot. But there’s not really a consistent, scalable way to evaluate whether a SKU is actually pulling its weight or not.

Without a disciplined process, you risk:

Losing trips when shoppers don’t find expected products

Over-indexing in certain categories (duplication and waste)

Missing regional favorites or trending products

Ignoring KVIs (Key Value Items) that drive price perception

Overstocking slow movers that tie up capital and labor

The Data Behind Smarter Assortment

Too often, SKU reviews stop at a sales rank report. But velocity alone doesn’t tell the whole story. With ClearDemand, retailers bring together multiple data signals to answer the real question:

What role should this item play in this store, for this shopper, at this time?

Which means you should look this data, too:

- Sales / Inventory: Identify movement, turns, cost to carry

- Elasticity: Understand if price change could improve performance

- Affinity: Detect halo or cannibalization effects

- Location: See what works in different regions

- Category Roles: Don’t cut strategic items with long-term value

ClearDemand has the infrastructure to analyze SKUs and give you the information to act on.

Assortment Optimization in Action

A regional grocery chain came to ClearDemand with a bloated assortment, the result of years of vendor-driven adds. They had overlapping SKUs, private label inconsistencies, and no clear framework for cuts or adds.

With ClearDemand’s help, the retailer:

- Identified underperforming SKUs dragging down margin

- Uncovered regional preferences that justified targeted assortment

- Detected missing KVIs that hurt shopper perception

- Balanced private label vs. national brand positioning

Instead of guessing, the merchant team gained a data-driven playbook for both cutting and adding SKUs… leading to higher margins, fewer out-of-stocks, and stronger shopper loyalty.

Powerful Assortment Analytics

At ClearDemand, we’ve built assortment analytics for the realities of grocery: fast-moving categories, tight margins, and shopper expectations that shift quickly. (Click here to get time with our team!)

We bring data together: We combine your inventory and sales data with our science to evaluate each SKU based on how it performs and how it could perform with pricing or merchandising adjustments.

We spot risks & opportunities: We’ll help you determine what SKUs should be removed or reduced based on performance, carrying cost, or category overlap. You can identify which SKUs are missing in your assortment too.

We deliver answers: This isn’t a vague report. Our goal is to provide you with clear recommendations, backed by data and aligned with your strategy.

Merchants can make assortment decisions with confidence — protecting profit, meeting shopper demand, and staying ahead of competitors.

The Latest Insights – Straight to Your Inbox

Sign up for the ClearDemand mailing list for actionable strategies, upcoming events, industry trends, and company news.