Holiday 2025: Pricing Mistakes Retailers Can’t Afford

Reading Time: 11 Minutes

The 2025 holiday season will test every retailer’s pricing strategy.

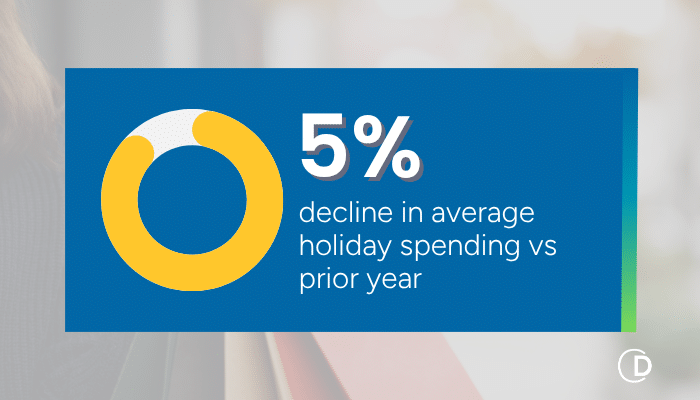

Shoppers are spending less and thinking harder about every purchase. PwC projects a ~5% decline in average holiday spending versus 2024 – meaning retailers will fight harder for a smaller share of wallet.

In grocery, that means shoppers will trade down more aggressively (to private labels, generics, and value lines). Even small price differences will sway loyalty.

Meanwhile, inflation and rising food costs continue to pressure margins. The USDA’s Food Price Outlook shows food-at-home inflation up 3.2% year-over-year as of August 2025, so any misstep in pricing or forecasting cuts straight into profit. Reactive price changes without clear guardrails will backfire.

No surprise here – competition is intense. Grocers now compete daily with dollar stores, mass merchandisers, and online delivery platforms. Shoppers are comparing across channels, making online vs. in-store alignment essential to preserve trust and price perception.

Trust is harder to earn. Consumers expect value and transparency. Inconsistent discounts, price jumps, or mismatched promotions erode your shoppers’ confidence fast. Every price on the shelf must make sense in the shopper’s mind and reinforce your value promise.

In short, every price matters.

Here are the most common pricing mistakes to avoid this holiday season and how data-driven retailers are using pricing science and automation to stay ahead:

1️⃣ Setting It and Forgetting It

Many grocers finalize holiday pricing and promotions weeks in advance (especially on key categories like turkeys, baking supplies, and beverages) then hesitate to adjust once the season starts. That rigidity might feel safe, but it’s risky in a market that changes daily and rewards agility.

Consumer demand, competitor prices, and cost inputs shift constantly. Without real-time adjustments, prices drift out of sync, leaving sales on the table.

The smarter move: Build flexibility into your holiday pricing plan, especially for high-velocity or perishable categories. Use elasticity-based models and rule-based guardrails that allow updates as conditions change.

2️⃣ Ignoring Competitive Blind Spots

Your shoppers aren’t comparing your prices in a vacuum – they’re standing in your aisles, phone in hand, comparing your pricing and selection to another store’s.

Retailers who rely on outdated or incomplete competitive data are effectively flying blind. Depending on inconsistent or unreliable feeds leaves room for gaps, mismatched products, or delayed info.

The smarter move: Invest in reliable competitive intelligence with verified data quality. Track store-level price movements, understand local competitors, and feed that intelligence directly into your pricing rules. You can’t manage what you can’t see.

3️⃣ Overusing Blanket Promotions

The temptation is real: one promo, one message, one nationwide price drop. Simple to execute and instantly margin-eroding.

In grocery, that one-size-fits-all approach is dangerous! Local competition, shopper demographics, and category dynamics vary by market. What drives traffic in one region might destroy margin in another…

A single national discount on a holiday item like ham might make sense in one banner or store cluster but in others, you’re simply subsidizing purchases that would have happened anyway.

The smarter move: Balance national vendor programs with localized, optimized promotions that reflect how shoppers actually respond. The result: promotions that feel sharper, more relevant, and more profitable.

4️⃣ Waiting Too Long to Markdown

Retailers often delay markdowns, hoping to squeeze out full-price sales, then panic once inventory piles up. By that point, the only option is steep clearance.

In grocery, that delay can mean spoilage, waste, and lost profit.

The smarter move: Grocers using markdown optimization can simulate multiple timing scenarios and understand the trade-off between waste, margin, and sell-through.

5️⃣ Misjudging Elasticity and Cannibalization

Price elasticity measures how sensitive demand for a product is to a change in price – and it isn’t some fixed number. It changes by store, by week, and by shopper behavior.

When one SKU goes on promotion, it can steal demand from others in the category. Price one pack size too low, and you may cannibalize your higher-margin formats.

In grocery, elasticity is the heartbeat of profitable pricing!

The smarter move: Identify where small price increases are safe. Focus promotions on highly elastic items where discounts drive true incremental sales. Predict cannibalization and halo effects across categories. Confidently balance price perception with profit protection.

6️⃣ Failing to Connect Pricing, Merchandising

Price is the promise you make to shoppers – but that promise falls apart when execution doesn’t align. We’ve all seen it: shelf tags that don’t match circulars, online prices that differ from in-store, promotions that confuse rather than convert. Those disconnects destroy shopper trust and brand perception.

The smarter move: Align pricing and merchandising. Create a shared visibility layer so all teams see the same data and intent. The best pricing plans are coordinated, not siloed.

Holiday Pricing Mistake Checklist

| Mistake | Risk | Smarter Move |

|---|---|---|

| Static price plans | Missed margin or competitive gaps | Optimized, rule-based pricing |

| Poor competitive visibility | Reactive decisions | High-quality competitive data |

| Blanket promotions | Margin erosion | Segment by region and elasticity |

| Late markdowns | Spoilage or forced clearance | Predictive markdown timing |

| Ignored cannibalization | Net profit loss | Constrained, elasticity-aware optimization |

| Siloed teams | Shopper confusion | Unified pricing + merchandising strategy |

Final Thought

The 2025 holiday season won’t reward retailers who play it safe — it will reward those who price with precision.

That’s where ClearDemand’s elasticity-based, rule-driven optimization gives retailers a clear edge.

Those who apply science, automation, and competitive insight will win bigger and faster. They’ll see the early signals like when elasticity shifts, when competitor prices move, when demand patterns break and they’ll act with confidence instead of reacting under pressure.

ClearDemand offers grocers best-in-class:

- Competitive Intelligence that’s accurate, normalized, and available at store level.

- Price Optimization that models elasticity and adheres to your pricing rules.

- Promotion Optimization that pinpoints what’s profitable and minimizes waste.

This holiday season, every price is a decision — and every decision is a chance to lead.

The Latest Insights – Straight to Your Inbox

Sign up for the ClearDemand mailing list for actionable strategies, upcoming events, industry trends, and company news.