What Does Mature Retail Pricing Look Like?

Reading Time: 7 Minutes

Top retailers understand that pricing is a strategic weapon, not an afterthought. There is lots of value in adopting a mature business processes for managing price…

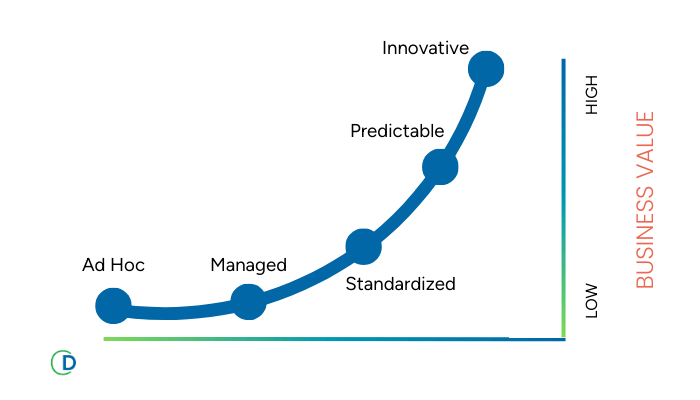

Price management maturity levels can be described as ad hoc, managed, standardized, predictable, and innovative. Where does your business fall on this spectrum?

Ad Hoc

Imagine your pricing and merchant teams drowning in a sea of spreadsheets. They’re spending countless hours manually updating prices, chasing down data from disparate sources, and constantly fighting through urgent requests. Price tends to be the same across all stores and ecommerce—minimal localization of price. Minimal ability to respond to cost changes and competitors.

Managed

Here, your sea of spreadsheets is a bit less chaotic. You have some reasonable management practices for price approval. There’s some localization of price. You’re able to respond to cost changes and competition, but response time is sporadic due to heavy manual workload on limited resources.

Standardized

Enterprise tools largely replace excel in at least some departments. Categories are reviewed on a regular cadence. Pricing data such as rules, recommendations, approval, and export history are documented and reside in a database. Reasons for price changes are archived in a database. Pricing rules drive pricing alerts and are localized. Standard price approval workflow is followed. Price exports are integrated with back-office systems. There is an immediate response to changes in cost and competition. Vendor deals are integrated into pricing tool and accounted for in planning decisions.

Predictable

The category review process is informed by enterprise tools equipped with some forecasting science and a measure of price elasticity. This includes the ability to manually change a price and see the forecasted impact on profit, revenue, and units. Price recommendations include at least some aspects of a “separate” optimization calculation that is independent of the rules and strategy but perhaps blended in through some type of ‘weighted’ soft rule. Regular and Promotional pricing activities are still siloed. Some reports measure business performance and inform business decisions.

Innovative

Category role and intent including strategy for pricing line structure is codified in the enterprise tool and drive the price recommendations. The “integrated” forecast is highly accurate and accounts for price, promotional lift, intro/disco, seasonality, cannibalization, affinity, planogram lift, stock outs, and other demand influencing factors such as weather or Covid.

The integrated forecast informs replenishment decisions and assortment planning to improve service level and minimize carrying cost. The influence of price and promotion on basket metrics are understood and drive personalized offers. Enterprise tools feature “joint” optimization fully constrained by rules and show both the unconstrained and constrained opportunity curves (efficient pricing), so the organization understands the cost of rules and how to trade-off profit and revenue effectively.

Enterprise tools support multiple pricing scenarios each with different pricing strategies to evaluate tradeoffs in profit, revenue, units, and price image associated with a change in strategy. Regular and promotional pricing decisions are optimized jointly using the integrated forecast so that categories margins can be managed holistically. Product and store attributes are leveraged to manage new-product pricing, line structure, and price localization, KVI pricing as well as decisions on assortment. The business has targeted performance metrics which are measured and optimized. Plan versus forecast versus actual are frequently compared and continuously improved.

The Latest Insights – Straight to Your Inbox

Sign up for the ClearDemand mailing list for actionable strategies, upcoming events, industry trends, and company news.